hotel tax calculator nc

North Carolina has a 475 statewide sales tax rate. North Carolina Department of Revenue.

State And Local Sales Tax Calculator

So if you purchase a home or land for 900000 the revenue tax would be 900000 divided by 1000 and multiplied by 2 which.

.jpg)

. NA tax not levied on accommodations. Our calculator has recently been updated to include both the latest Federal. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

North Carolina now has a flat state income tax rate of 525. Hotel Tax Calculator Alberta. Hotel Tax Calculator Alberta.

No additional local tax on accommodations. Rentals of Hotel Rooms. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223.

The North Carolina Tax Calculator. Overview of North Carolina Taxes. 1 State lodging tax rate raised to 50 in mountain lakes area.

Im not sure about that particular hotel but the last time I stayed in Raleigh in November 10 I had to pay NC sales tax. Of that 6 15 funds the Tourism Product. DEC 23 2021.

Provincial sales tax pst bulletin. PO Box 25000 Raleigh NC. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

North Carolina Property Tax Calculator. Our calculator has been specially developed in order to. Your average tax rate is 1198 and your.

Average Local State Sales Tax. C2 Select Your Filing Status. You can also explore canadian federal tax brackets provincial tax brackets and.

Estimate Your Federal and North Carolina Taxes. The tax rate is 2 per 1000 of the sales price. Your tax per night would be 1950.

North Carolinas property tax rates are relatively low in comparison to those of other states. North Carolina Income Tax Calculator. The british columbia annual tax calculator is updated for the 202223 tax year.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. North Carolina Income Tax Calculator 2021. The act went into full effect in 2014 but before then North Carolina had.

The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability. Single Head of Household. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

Overview of North Carolina Taxes. The state income tax rate in North Carolina is under 5 while federal income tax rates range from 10 to 37 depending on your income. C1 Select Tax Year.

North carolina has not always had a flat income tax rate though. Currently the hotel tax adds 6 to the 7 sales tax for a total of 13 for each night visitors spend in a hotel in the county. This income tax calculator can help estimate your.

North carolina state sales tax. Just enter the wages tax withholdings and other information required. Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500.

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Your Waxhaw North Carolina Real Estate Questions Answered

Sales Taxes In The United States Wikiwand

The Johnson County Kansas Local Sales Tax Rate Is A Minimum Of 7 975

Hotel Prices Why Urban Hotels Cost So Much More Than Houses Or Apartments In The Same City

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Occupancy Tax Rates For Airbnb In Major Cities Shared Economy Tax

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Understanding Hotel Taxes Resort Fees Deposits For Incidentals Your Mileage May Vary

Sales Tax Calculator And Rate Lookup Tool Avalara

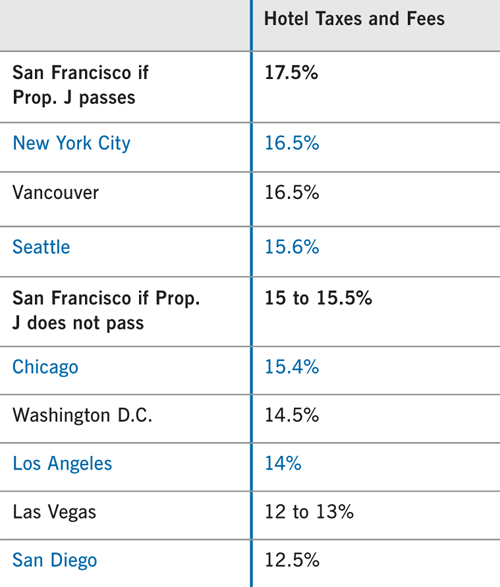

Proposition J Hotel Tax Increase Spur

.jpg)

Hvs 2020 Hvs Lodging Tax Report Usa

States With The Highest Lowest Tax Rates

How High Are Spirits Taxes In Your State Tax Foundation

Occupancy Tax Carteret County Nc Official Website

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities